Retirement advisors review and analyze the client's financial position, annual income, and outstanding debts in order to develop a custom retirement plan. This plan serves as a guideline for clients' retirement decisions. The advisor can make recommendations regarding a variety retirement planning products. When working with an advisor, the client should expect to pay a fee for this service.

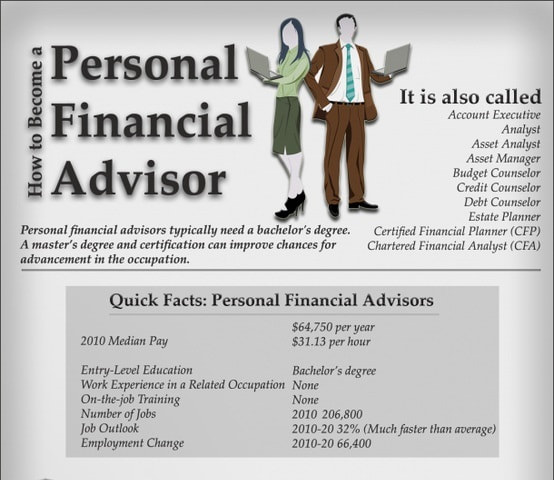

Qualifications for a retirement advisor

The ability to efficiently manage retirement funds is one of the requirements for a retirement adviser. This is why it is important to have knowledge in the areas of economics and taxation. Having these credentials can help you establish your credibility and be a valuable asset for clients.

A bachelor's degree is required for those who want to be a retirement advisor. An ideal degree is in finance, business, and a related field. However, experience is still the most powerful teacher. Advisors are taught by real-world experiences. On-the-job training is a common requirement for advisors. This can take up to one year. This training helps advisors learn how to do their jobs and develop a client base. In addition, they must complete certification programs, which require additional schooling and work experience.

Cost of a retirement consultant

Although every person is different in cost, there are some common guidelines that you can use to help you choose the right advisor. While fees can be anywhere from $700 up to $3,500 in general, they are not always related to the purchase price of your investments. Before signing any documents, it is important you get the fee in writing. Be sure to inquire about the possibility of follow-up meetings.

Some advisors do not charge any fees for managing assets and work only on a fee basis. Some advisors charge a flat monthly or annual fee. Fee-only advisors charge an initial fee of up to $1,000. The work involved will result in a higher initial fee, but subsequent meetings should cost less.

Conflicts of interest in working with a retirement advisor

There are risks involved in working with a retirement advisor. While advisors are supposed not to be in your best interest but can sometimes cause conflicts of interests when financial advisors get back-door and hidden fees. They could direct you to low-return, high-cost investments that offer hidden fees that favor Wall Street firms. Clients lose on average one percent of their investments each year.

Relationships with other professionals, organizations or centers of influence could lead to conflicts of interests. Compliance guidelines require advisors disclose their business affiliations, and to explain how they manage conflict of interest. However, the guidelines don't prohibit conflicts of interest. A good retirement advisor should disclose all financial relationships with which they are affiliated.

Time to engage a retirement planner

If you are just starting your career or are planning your retirement, it may be time to hire a financial advisor. A financial advisor is able to help you plan your retirement plans and avoid financial hardship later. The advisor should have the appropriate experience and expertise to provide sound advice. They can also help you select the right insurance policies and strategies that will minimize your tax liabilities.

It is a good idea to interview several advisors before you choose the best one. It is important to find an advisor who has experience working with clients similar to you, such as those of color and LGBTQ. You can also inquire about their fees. They may charge by the hour or retainer. You should have a written agreement in place with your financial advisor before you hire them.

FAQ

How do I choose the right consultant?

There are three major factors you should consider:

-

Experience - How skilled is the consultant? Is she a beginner? Intermediate? Advanced? Expert? Does her resume show that she has the necessary skills and knowledge?

-

Education - What did he/she learn in school? Did he/she continue to take relevant courses after graduation? Is there evidence that he/she learned from the writing style?

-

Personality - Do we like this person? Would we prefer him/her working for us?

-

The answers to these questions help determine if the consultant is right for our needs. If you do not have the answer, it is worth interviewing the candidate to find out more.

Who hires consultants

Many organizations hire consultants to assist with projects. These include small businesses, large corporations, government agencies, non-profits, education institutions, and universities.

Some consultants work directly with these organizations while others freelance. In both cases, the process for hiring depends on how complex and large the project is.

When hiring consultants, you will probably go through several rounds of interviews before choosing the person you think would be best suited for the position.

What types of jobs are available as a consultant?

Consultant work requires a deep understanding of business strategy, operations, and other aspects. Understanding how businesses work and their place in society is also essential.

Consultant work requires excellent communication skills and the ability to think critically.

Consultants need to be flexible as they might be assigned different tasks at different times. They must be flexible and able to change directions quickly if needed.

They must be prepared to travel extensively for the clients they represent. This type work can take them anywhere in the world.

They should also be able manage stress and pressure. Consultants may sometimes be required to meet tight deadlines.

Consultants may work long hours. This can mean you might not always receive overtime compensation.

Do I need to pay tax on consulting income?

Yes, tax will be payable on any consultancy profits. The amount you earn depends on your annual income.

If you are self employed, you can claim expenses in addition to your salary. This includes rent and childcare.

You can't deduct the interest on loans, vehicle damage, or equipment costs.

You cannot claim back less than PS10,000 in a given year.

But even if you're earning more than this threshold, you might still be taxed depending on whether you're classed as a contractor or employee.

Employers are taxed via PAYE (pay as your earn), and contractors through VAT.

Statistics

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

- My 10 years of experience and 6-step program have helped over 20 clients boost their sales by an average of 33% in 6 months. (consultingsuccess.com)

External Links

How To

How do I start a consulting business without any money?

Start your own consultancy company with a simple and efficient method - no capital investment required!

This tutorial will show you how to make money online from home. It will also help you improve your skills and earn extra cash.

Here are some secrets to help you get traffic on demand.

This method is known as "Targeted Traffic". This method was designed specifically for you to do this...

-

Choose the niche that you are interested in.

-

Find out which keywords are used by people to search for solutions on Google.

-

Write content around these keywords.

-

Post your articles on article directories.

-

To promote your articles, use social media.

-

Develop relationships with experts in the niche and influencers.

-

Be featured on these blogs and websites.

-

Grow your email list by sending out emails.

-

Start making money.